Private Limited Company

A Private Limited Company is one of the most preferred and recommended types of business structures in India.

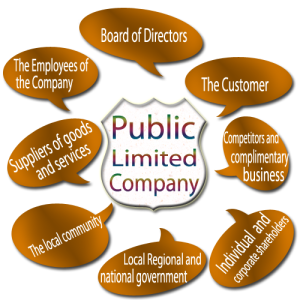

Public Limited Company

A Public Limited Company (PLC) is a type of company that can offer its shares to the general public. It is registered under the Companies Act, 2013.

Joint Venture Company

A Joint Venture Company is a business arrangement where two or more parties come together to form a new entity or collaborate on a specific project.

Limited Liability Partnership (LLP)

A Limited Liability Partnership (LLP) is a business structure that combines the benefits of a partnership and a company.

One Person Company (OPC)

A One Person Company (OPC) is a unique type of business entity introduced under the Companies Act, 2013 in India.

ROC Filing

ROC filing refers to the submission of statutory documents and returns to the Registrar of Companies as required by law.

DIR-3 KYC

DIR-3 KYC is an annual compliance requirement under the Companies Act, 2013, where all directors of Indian companies must verify and update their personal details with MCA.

Corporate Tax

Corporate Tax is a direct tax imposed on the net income of companies. It applies to both domestic companies and foreign companies operating in India.

Direct & Indirect Tax

Direct Taxes are those taxes that are directly paid by an individual or entity to the government. The burden of these taxes cannot be shifted to anyone else.

Income Tax Return (ITR) Filings

An Income Tax Return (ITR) is a form where a taxpayer declares their income, expenses, deductions, taxes paid, and other details to the Income Tax Department.

Income Tax Appeal & Cases

An Income Tax Appeal is a formal process of challenging an order passed by the Assessing Officer (AO) under the Income Tax Act, 1961.

12A & 80G Registration

Are you running an NGO, trust, or charitable organization? To enjoy income tax exemptions and offer tax benefits to your donors, 12A and 80G registration are essential.

TDS & TCS Return filings

Are you deducting or collecting taxes under TDS or TCS provisions? Then filing your quarterly TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) returns is mandatory under the Income Tax Act.

Goods & Service Tax- Overview

GST (Goods and Services Tax) is one of the most important tax reforms in India, introduced to simplify the indirect tax system.

GST Registration

GST Registration is the process by which a business gets enrolled under the Goods and Services Tax Act, 2017.

GST Returns

If your business is registered under GST, filing GST returns is mandatory—whether or not you’ve made any sales or purchases.

GST Appeal & Cases

GST is a dynamic and evolving tax law, and businesses often face disputes, penalties, or notices from tax authorities. If you've received a show cause notice, assessment order, penalty, or audit issue.

Accounting Overview

Accounting is the systematic process of recording, summarizing, analyzing, and reporting financial transactions of a business.

Accounting & Book Keeping

Every successful business is built on a foundation of accurate accounting and efficient bookkeeping. At Aadesh Kumar & Associates, we provide professional Accounting & Bookkeeping services tailored for startups.

Income Tax Audit

Every business and professional earning above a certain limit must get their accounts audited as per the Income Tax Act.

GST Audit

As your business grows, maintaining 100% GST compliance becomes crucial. A GST Audit is a detailed examination of your GST records, returns, and transactions to ensure that all laws and regulations under the Goods and Services Tax regime are properly followed.

Statutory Audit

A Statutory Audit is a mandatory audit of a company’s financial records to ensure accuracy and compliance with applicable laws.

Stock Audit

A Stock Audit, also known as Inventory Audit, is essential for businesses to verify the actual stock levels against the recorded data.

Income Tax Audit

An Income Tax Audit is not just a legal obligation—it’s a crucial step for transparent financial reporting and avoiding scrutiny by the Income Tax Department.

Trademark Registration

A Trademark is a recognizable sign, logo, name, phrase, design, or symbol that distinguishes your goods or services from others.

Copyright Registration

Copyright Registration gives you the legal ownership of your creative content and helps protect it from unauthorized use, theft, or copying.

Patent Registration

Patent Registration in India gives you exclusive legal rights to your invention and prevents others from using, selling, or copying it without your permission.

Food Safety and Standards Authority of India (FSSAI License)

The FSSAI license is a legal approval issued under the Food Safety and Standards Act, 2006, which allows food businesses to operate while following food safety norms.

ISO Certification

ISO (International Organization for Standardization) is a global body that sets standards for quality, safety, efficiency, and management systems in businesses.

IECCode

Import Export Code (IEC) is a unique 10-digit code required by any business or individual who wants to import or export goods and services from India.

MSME Certification (Udyam Registration)

Udyam Registration, previously known as MSME Registration, is the official process for registering your business as a Micro, Small, or Medium Enterprise with the Government of India.

EPEO & ESIC Registrations

EPFO Registration is mandatory for organizations employing 20 or more employees. It is governed by the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952.

Labour License

Labour License registration is mandatory under the Contract Labour (Regulation & Abolition) Act, 1970. It ensures transparency, legal compliance, and safety for both employers and workers.

Trade License

Running a shop, restaurant, manufacturing unit, or service business? You need a Trade License from your local municipal authority to operate legally.

Society Registration

Then Society Registration under the Societies Registration Act, 1860 is the best way to give your group a legal identity.

Trust Registration

Trust Registration is the best way to establish a non-profit organization with a formal legal identity.

NGO Registation

If you're passionate about creating social impact and serving communities, then registering an NGO (Non-Governmental Organization) is the best way to start your journey

Section 8 NPO Registation

A Section 8 Company is a non-profit organization registered under Section 8 of the Companies Act, 2013. It is formed “to promote commerce, art, science, research, education, social welfare, religion, charity.